The 7 Deadly Sins of Personal Finance: Are You Making These Costly Mistakes?

There are many common financial mistakes that individuals can make, which can lead to financial difficulties and stress. Some common financial mistakes can be easily avoided, you just have to know about them. and in this post, I will try to explain them one by one.

(toc) #title=(Table of Content)

The 7 Deadly Sins of Personal Finance

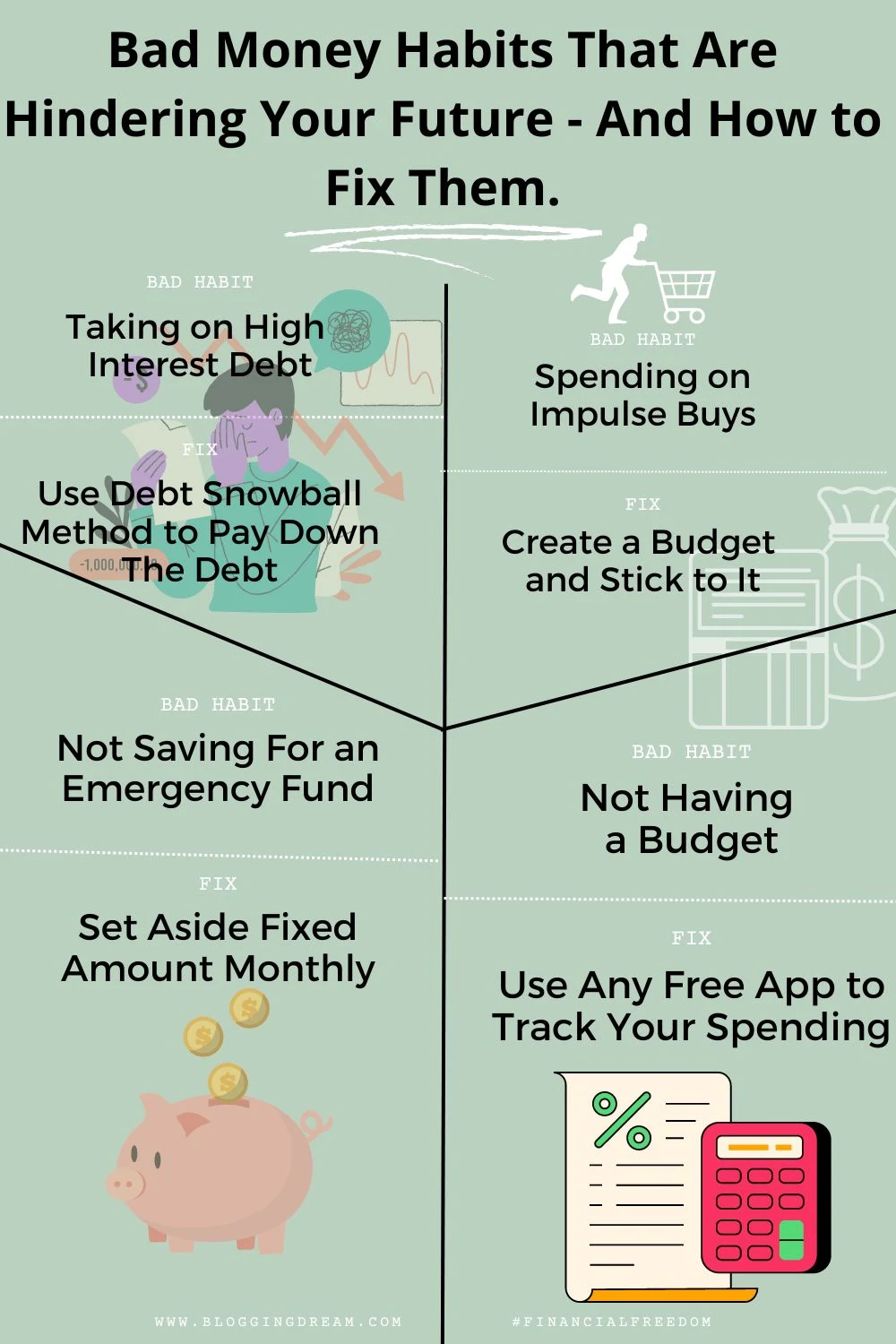

Not creating a budget

A budget can help individuals manage their money effectively, and allocate their income towards their different spending categories and financial goals. However, many people fail to create a budget and may end up overspending and accumulating debt. According to a survey by Bankrate, only 39% of Americans have a written budget.

Not saving for emergencies

Emergencies, such as a medical emergency or a car repair, can be expensive and unexpected. Without savings, individuals may be forced to borrow money or use credit to pay for these expenses, which can lead to financial difficulties. According to a survey by the National Endowment for Financial Education, 62% of Americans do not have enough savings to cover a $1,000 emergency.

Not investing in the future

Investing can help individuals grow their wealth and achieve their financial goals, such as retirement or buying a house. However, many people fail to invest and may miss out on the potential for higher returns. According to the Investment Company Institute, only 49% of Americans own stocks, either directly or through mutual funds or retirement accounts.

---------------------------------------------------

you can check out my article about the best investment opportunity you can grab now

---------------------------------------------------

Carrying High-Interest Debt

Carrying high-interest debt, such as credit card debt, is a common financial mistake that can cost you a lot of money in interest charges. To avoid this mistake, it’s important to pay off high-interest debt as soon as possible and to only use credit cards for purchases that you can afford to pay off in full each month.

Not Protecting Your Finances with Insurance

Not protecting your finances with insurance is another common financial mistake. Without insurance, you risk losing everything if an unexpected event occurs, such as a car accident or illness. To avoid this mistake, it’s important to purchase insurance that covers your needs, including health insurance, life insurance, and property insurance.

Impulse Purchasing

Impulse purchasing is a common financial mistake that can lead to debt and financial stress. To avoid this mistake, it’s important to take time to think about purchases before making them and to stick to a budget.

Not Seeking Professional Advice

Finally, not seeking professional advice is a common financial mistake. Financial advisors can help you make smart decisions about your money and provide valuable advice on investments, retirement planning, and debt management. To avoid this mistake, it’s important to seek out the advice of a qualified financial advisor.

To avoid these common financial mistakes, individuals can take the following steps:

Ways to Protect Your Finances

Create a budget

A budget can help individuals manage their money effectively, and allocate their income towards their different spending categories and financial goals. To create a budget, track your income and expenses, and allocate your income towards your different spending categories.

if you want to learn how to create a budget step by step check out my article: How to Create a Budget That Works for You in 5 Simple Steps

Save for emergencies

Emergencies can be expensive and unexpected, so it's important to have savings to cover these expenses. To save for emergencies, set aside a portion of your income each month, and deposit it into a savings account or other safe and liquid investment. Aim to save enough to cover at least three to six months of expenses.

Invest for the future

Investing can help individuals grow their wealth and achieve their financial goals. To invest, research different investment options, such as stocks, bonds, or mutual funds, and choose investments that align with your financial goals and risk tolerance. Be sure to diversify your investments, and consider consulting with a financial advisor to help you make informed decisions.

---------------------------------------------------

you can check out my article about the best investment opportunity you can grab now

---------------------------------------------------

By avoiding common financial mistakes, such as not creating a budget, not saving for emergencies, and not investing for the future, individuals can improve their financial health and achieve their financial goals. By making smart financial decisions, individuals can build a strong financial foundation, and enjoy greater financial security and peace of mind.

Best Budgeting apps

Budgeting apps are mobile or web-based applications that can help individuals manage their money and create a budget. Budgeting apps typically allow users to track their income and expenses and allocate their income toward different spending categories, such as housing, food, and transportation.

Free Monthly Budget Planner here: (getCard) #type=(download) #title=(Monthly Budget Planner) #info=(free) #button=(Download)

Some popular budgeting apps include

Mint: Mint is a free budgeting app that allows users to track their income and expenses, create a budget, and monitor their progress toward their financial goals. Mint also offers features such as bill reminders, credit score monitoring, and personalized advice.

YNAB (You Need a Budget): YNAB is a paid budgeting app that uses the envelope budgeting method, where users allocate their income towards different spending categories, and track their spending using virtual envelopes. YNAB also offers features such as tracking net worth, categorizing transactions, and connecting to bank accounts and credit cards.

PocketGuard: PocketGuard is a free budgeting app that focuses on helping users save money. PocketGuard allows users to track their income and expenses, create a budget, and monitor their progress toward their savings goals. PocketGuard also offers features such as automatic categorization, bill reminders, and personalized advice.

Overall, budgeting apps can be a helpful tool for individuals looking to manage their money and create a budget. By using a budgeting app, individuals can track their income and expenses, allocate their income towards their different spending categories, and monitor their progress toward their financial goals.

Financial Calculators

There are many different types of financial calculators available, each of which can be used to perform a specific type of calculation. Some common types of financial calculators include a mortgage calculator, which can be used to determine monthly mortgage payments based on the loan amount, interest rate, and loan term; a retirement calculator, which can be used to estimate how much money a person will need to save in order to retire comfortably; and a savings calculator, which can be used to determine how long it will take to reach a savings goal based on the current balance, monthly contributions, and interest rate.

example of how a mortgage calculator might be used

Suppose a person is looking to buy a house and has found one that they like for $200,000. They have been approved for a 30-year fixed-rate mortgage at an interest rate of 3.5%. Using a mortgage calculator, they can input these values to determine the monthly mortgage payment they will need to make.

Here is how the calculation might look:

Loan amount: $200,000

Interest rate: 3.5%

Loan term: 30 years

Based on these inputs, a mortgage calculator will calculate a monthly mortgage payment of approximately $898.

This calculation is only an example, and the actual monthly mortgage payment will depend on a variety of factors, including the loan amount, interest rate, and loan term. It is important to use a financial calculator carefully and to consult with a financial advisor for personalized advice.